Commonwealth Budget

It is difficult to find much in the way of compliments for the 2017-18 estimated budget presented by the Turnbull government, or for the budget projections (not estimates) for the following three years. It appears, rather, to involve the abandonment of the policy of “smaller government”, but without saying so. Indeed it is difficult to say what the Liberal Party under Turnbull now stands for. Various remarks made in public by Turnbull and Scott Morrison left something to be desired in regard to the functioning of the economy, particularly in regard to justifying (sic) the levy on major banks, and presenting an encouraging message. Several commentators have suggested that the rationale is to adopt policies similar to those pursued by Labor in the hope that this will improve the Coalition’s polling. Shorten has rejected this and will doubtless have more to say about it in his reply on Thursday evening (but he will likely retain the deficit levy on higher income groups, which the Coalition says it will abolish as promised ).

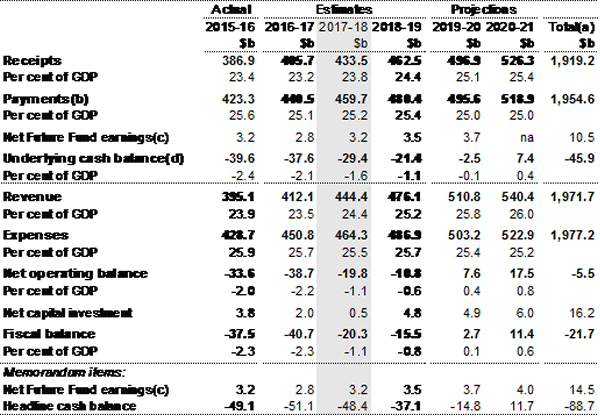

This is not the place to try to examine in detail the various policies and announcements, which are already well covered in the media. I confine myself here to focussing on the main budget aggregates as highlighted in Budget Paper No 1. These provide an indication of the policy approach by the government. In doing so it needs to be recognised that the margin for error tends to be greater for the three years after 2017-18. The table below from Budget Paper No1, which is not fully legible, shows that:

- Next financial year the deficit is still estimated at $29.4bn or 1.6% of GDP, a reduction of only about $8bn on the current financial year;

- Expenditure in 2017-18 is estimated to increase by 4.4%, slightly faster than in 2016-17 (+ 4.1%);

- Revenue is estimated to increase by 6.8% in 2017-18, considerably faster than in 2016-17 (+4.8%);

- Projections for the three years after 2017-18 do provide for the elimination of the deficit and the establishment of a small surplus of $7bn in 2020-21;

- While this would be a “good” outcome, it would almost entirely reflect a projected faster increase in revenue (+ 21.4%) than expenditure (+12.9%) between 2017-18 and 2020-21. Revenue would increase to 25.4% of GDP (1.6 percentage points higher than in 2017-18) while expenditure would fall by only 0.2 percentage points of GDP. The large increase in revenue reflects bracket creep as well as policy decisions;

- Policy decisions (mostly reflecting increases in taxes such as the Medicare and Banks levies) provide additional revenue of $1.9bn next year and $8.5bn in 2020-21. Note that these increases are described as “levies” not “taxes”!;

- Net Debt is estimated to increase by about $30bn to $354.9bn in 2017-18 (19.5% of GDP) and to still be at $366.2bn in 2020-21 (17.6% of GDP).

A number of excellent comments have been made but I have attached only three, Andrew Bolt and two by Terry McCrann (Federal Budget 2017 and Scott Morrison’s stick ‘em up). Bolt describes the budget as “a Labor Budget” and suggests we should “Be afraid, Very Afraid” of what would happen with a Labor victory. McCrann describes the budget as a “dangerous disgrace” and characterises Scott Morrison as the “Willie Sutton” of treasurers (Sutton was apparently a US bank robber in the 1930s). McCrann also says that, when speaking on Sky news, “Peta Credlin was exactly right. This is a budget for the next Newspoll”. But will the next Newspoll improve for the Coalition and Turnbull? It seems unlikely.

Table 3: Australian Government general government sector budget aggregates

(b) Equivalent to cash payments for operating activities, purchases of non-financial assets and net acquisition of assets under finance leases.

(c) Under the Future Fund Act 2006, net Future Fund earnings will be available to meet the Government superannuation liability in 2020-21. From this time, the underlying cash balance includes expected net Future Fund earnings.

Excludes expected net Future Fund earnings before 2020-21.